Ross Dawson works globally as a futurist, keynote speaker and strategy advisor, inspiring audiences with a deeply positive and pragmatic focus on the potential of the future. He is Founding Chairman of the Advanced Human Technologies Group of companies, spanning professional services, web publishing and software development, and the bestselling author of books including Living Networks, which The New York Times credited with predicting the social media revolution.

He has delivered keynotes and strategy workshops in over 30 countries for leading organisations such as American Express, Coca-Cola, Commonwealth Bank, Dubai Ministry of Finance, Gartner, Google, IBM, KPMG, Macquarie Bank, Oracle, Procter & Gamble, PwC, Roche, Telstra and Visa. Media appearances include CNN, Bloomberg TV, SkyNews, ABC TV, Today and Sunrise shows, Washington Post and many others.

Interviewer: “What inspired you to become a futurist?”

Ross: “Since I was young I always thought it would be amazing to be a futurist, to be able to think about the future for a living, look at where the world is going, and where we are going as the human race. I feel very fortunate to have created that career and role for myself, through hard work over many years.”

Interviewer: “How did you make a career out of being a futurist?”

Ross: “People often ask me, “how do you become a futurist?” The trite but true answer is that you claim you are, and people either believe you or they don’t. Anybody can talk about the future. You need to have credibility so that people will listen to you and give credence to what you are saying. My definition of a futurist is someone who helps people and organisations think about the future so that they can act better in the present.

My personal journey began over 20 years ago by studying and applying scenario planning, a well-established future discipline. I have been studying and using futurist methodologies for over two decades now, but it was my first two books that gave me the credibility to pursue the profession of futurist on a bigger scale.

My first book was on knowledge-based relationships, with a subtitle of ‘The Future of Professional Services’. The book was highly successful and anticipated the dynamics of the high-value professional services industries today. My second book was Living Networks, which looked at the implications of the hyper-connected economy. The New York Times credited it with predicting the social networking revolution before any of today’s social networks existed.

I was looking to the future but even then my primary role wasn’t as a futurist. These two books’ success gave me the credibility to work as a futurist with many leading organisations around the world. My role is not to predict the future, my role is to help executives to think about the future more than they usually do or in different ways than they normally do, so that they can be more effective in their roles as directors and leaders.”

Interviewer: “What do you see are some of the challenges that IT professionals are facing?”

Ross: “Technology is, of course, becoming more and more central to society, business, and organisations. That’s been clear since we started to use computers to process our payroll to the introduction of email as a transformative technology for organisations, through to today where absolutely extraordinary possibilities are being enabled through technology.

The role of the IT professional has moved from being a supporting function to become far more strategic. Nicholas Carr, a former Editor of the Harvard Business Review wrote a provocative article in the Harvard Business Review which stated that “IT doesn’t matter”. He argued that technology is a commodity, just like electricity or other basic functions, so you should treat it as a commodity, spend less on it and focus on what does matter. However, among others, Andrew McAfee & Erik Brynjolfsson of MIT have done studies that showed that those organisations that invest more in technology are in fact differentiated in their industries and perform better.

If you ask which of these ideas is true, the answer is in fact, both are true, in the sense that there are aspects of technology that are commoditised, they are basic functions of the organisations such as accounting and communication, but there are other aspects of organisational technology that are absolutely unique and strategic and shape the organisation’s success.

IT leaders must recognise that there are two possible paths forward for them. One is that boards and executives see IT as a commoditised function which should always be asked to do the same thing or better with less money and resources. Alternatively, the company leaders recognise the critical strategic role of technology and support it moving to the center of the organisation. This, of course, requires the technology leaders to clearly demonstrate the vital role of technology to the future of the business.

As such, one of the critical challenges today for IT leaders today is the fact that they do need to be in both of these worlds. They need to manage core technologies, which you could call commoditised but are absolutely underpinning the organisation and if they go down, the organisation goes down. But at the same time, they need to be exploring new domains including the applications of AI, distributed technologies including blockchain, sensors and IoT and other domains that can create immense value and new possibilities. There are so many new emerging possibilities that it is challenging to continually explore the possibilities of these new technologies, how they’re applied to these organisations and at the same time having the responsibility of keeping the engine room running that supports the organisation.”

Interviewer: “What would you recommend IT Leaders start taking action towards to prepare for the future?”

Ross: “There are a number of facets to how you manage the world of emerging technologies at the same time that you manage core technologies. The starting point is that of leadership, where IT leaders have to take this role upon themselves if it is not given to them, being the technology strategy leader in helping the board and executives to understand the possibilities and the implications of technologies and what that might mean for the organisation. Whether they are recognised in that role or not, they need to take that role.

In managing emerging technologies, one of the key starting points is in governance, because new technologies can have unintended consequences. This is very obvious in the role of data governance amidst the proliferation of data, with many legal implications, but also in terms of the possibilities and the implications of technologies such as AI, which is itself based on massive amounts of data. There needs to be deep thinking around the ethics of technologies, and what is required to create value in ways that protect the future of the organisation rather than put it into danger.

Leaders must set strategic paths or roadmaps to explore possibilities, using lean start-up practices within large organisations to marry these two modes. One of the most important challenges of all is in talent, of course: being able to attract, retain and develop the most talented people who are able to work effectively on leading-edge projects, and manage the dynamics of some people working on more exciting projects than others.”

Interviewer: “What do you see some of the new trends and behaviours of IT being in the next 3-5 years?”

Ross: “One of the most important issues is the transformation of the IT function. You need to look at what is the nature of the IT function today and what will it need to be in 3 or 5 years from now, and from there what are the things that need to be done to enable a successful transformation.

We have been talking about cloud in various guises since the beginning of the millennium, however effectively managing the continuing shift of the mix of where data and processes reside, whether they be inside or beyond the organisation, is critical.

AI is of course on everyone’s agenda in terms of the business applications, for manufacturing, robotics, business process automation and so on, but the next phase which is still quite early is the application of AI to the management of IT itself. This is where AI is applied to processes such as database optimisation, staff allocation, or coding different layers of applications. One important application is in responding to cyber-attacks, which is an accelerating race because both attackers and defenders are using increasingly sophisticated systems. We clearly need to be able to respond faster than humans can to attacks.

We can now certainly start to use and deploy AI systems for optimising or enhancing the management of the IT function. The truly strategic issue today is how you use the most sophisticated IT professionals together with AI and machine learning to achieve your outcomes. That is a strategic challenge, one giving real differentiation to those organisations that are able to effectively combine AI tools applied to the IT function together with human professionals.”

Interviewer: “Are there areas you are interested in learning more about?”

Ross: “Since the future of IT is centred on how human skills and technology work together, a key interest of mine is in productive interfaces between corporations and start-ups. We have a long history in this space, of course, we have many accelerators, hackathons and similar programs yet I still think that there is far more possible in getting true value from working with start-ups in a corporate context.

We still need to discover and develop the structures and the mechanisms which can make that most effective. We are still working out how to bring that entrepreneurial spirit, ideas and technologies to be truly valuable in a corporate environment. This is something we have been exploring for a long time, but there is still more to discover in how to do that extremely effectively.”

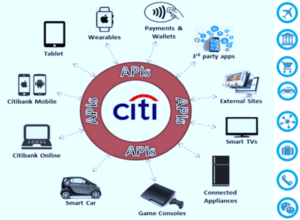

Citibank has created multiple revenue streams using APIs to support building new partnerships for growth and customer acquisitions. Study shows that banks that embrace the Open Banking APIs are expected to grow revenue by over 20% while those that are uninterested will decline by 30% by giving away their market share to disruptive challengers emerging in the market by 2020.

Citibank has created multiple revenue streams using APIs to support building new partnerships for growth and customer acquisitions. Study shows that banks that embrace the Open Banking APIs are expected to grow revenue by over 20% while those that are uninterested will decline by 30% by giving away their market share to disruptive challengers emerging in the market by 2020.